Before GST the indirect tax regime contractor service charge covers three types of taxable actions. The sale or lease of a house after a non-substantial renovation is generally exempt from GSTHST.

The Government On November 10 2017 Reduced Gst Rates Across Various Consumer Discretionary Categor Goods And Service Tax Finance Stock Market Stock Market

Whereas now it is uniform and no concessional forms are involved.

Impact of gst on building materials. Comparison with Contractor Service Fees and Building Material Price Before and After GST. GST Rate on Cement. This rule does not apply to input costs for example material or contracted services on which GSTHST has already been paid.

Pipes are subject to GST at a rate of 12. The principle thought of GST is to supplant existing expenses like esteem included assessment extract obligation administration duty and deals charge. The GST for building materials ranges between 5 and 28.

Kitchen utensils that are useful in day to day life become cheaper than the previous. GST as it is known is good to go to be a distinct advantage for the Indian economy. Most imported item in the construction industry is steel and the rates for the same is similar under GST.

The realty sector however continues to reel under the pressure of heavy taxes since the GST on construction materials such as cement sand steel bricks and stones continues to be hefty. Such a high rate of tax is significantly responsible for increasing the cost of the infrastructure sector. The Goods and Services Tax GST covers real estate in India through works contracts and building and constitution works as all components used in the development work attract GST.

The Harmonized System Nomenclature HSN code decides the GST for various materials. GST Rate on Building Materials. Earlier excise duty component was 125 VAT varied from 5 to 135 for products depending on the state.

The GST on construction materials is on the higher side and hence the cost will not come down much unless manufacturers are able to optimize their product pricing after adjusting for GST themselves. Building bricks and bricks of fossil meals attract 5 GST. Cement bricks glass-based paving blocks attract 28 of GST rate.

You calculate the GSTHST based on the value of the amount paid or payable on such untaxed costs. Previously it was 125 ED and 5 VAT. To put it simply covered under the new regime is the Indian construction industry which continues to attract high rates of taxes through a blend of levies imposed on the purchase of various building construction.

India is one of the fastest-growing economies of the world and it cannot afford to have a complex tax system. Utensils like pan stainless steel cooker and many more are now charged with 12 of Goods and Services Tax GST. The goods and service tax GST are a value added tax levied in India on the supply of goods and services.

Raw materials like cement and steel have been fixed at a 28 taxation rate. Concludes that building materials and land acquisition are the major construction impact gain from the GST implementation further capital flow turnover is the prior and significant impact that developer facing and subsequently result to an increment on housing property price in which end buyer is the one who suffer the price increment where government is the one who plays an important role in transferring. NOTE GST on Cement categorised under SAC Code 995454 will be taxable at 28 GST.

Now lets look at the impacts of GST on the construction industry TMT Steel. Cement is subject to GST at a rate of 28. Builders used to buy from outside state to save tax where they would be paying 2.

BUILDING MATERIALS PRODUCTS As per reports GST on Wallpaper is increased from 185 to 28 with the same slab on Leather which had earlier enjoyed lower taxes. Refractory blocks bricks similar construction related ceramic goods have GST rate of 18 12 GST rate sets for fly ash bricks and sand-lime bricks. GST effect on construction materials like all types of natural sands stone cement concrete bricks blocks various types of tiles different types of alum.

Tiles like bricks attract GST rate in the range of 5 to 28. On GST implementation the biggest beneficiaries among the Building material companies are the sectors that have larger share of unorganized segment. On the other hand multicellular or foam glass in blocks panels plates shells or similar forms attract a 28 GST.

GST Rate on Pipes. Roofing and earthen tiles attract 5 GST whereas glazed ceramic flags paving. Ashok Kumar Bhaiya Somasundaram and Niraj Borikar agrees that GST is fair as majority of the basic materials in the building materials industry is in the 18 bracket.

Goods and Services Tax GST has a positive impact on the iron and steel and material made up of these. GST rate for bricks is in the range of 5 to 28 depending upon the nature of the bricks. As bricks used for the construction of a building is made of different raw materials also has different GST rates.

The Impact Of Gst On Varied Business Areas Gst Gstbill Business Tax Goods And Service Tax Business Challenge

Gst Impact On Construction Capital Costs Download Table

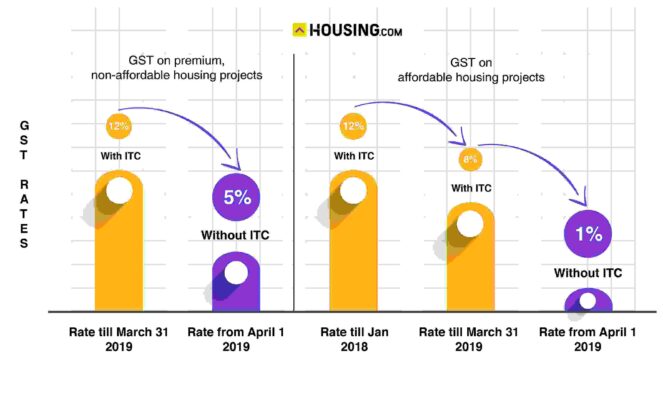

Gst On Real Estate Reduced 1 For Affordable 5 For Under Construction

What Is The Impact Of Gst On Building Materials Like Cement Tmt Bars Steel Bricks Paint Etc Quora

Gst Rate On Real Estate Under Construction Completed Property Moneychai

4 Best Design Construction Cost Estimation Methods Fohlio Estimate Template Cost Sheet Budgeting

How Gst Will Impact Home Prices The Property Market Gst Goods Service Tax Property Tax Market Income Inter Property Marketing House Prices Property

Gst Impact On Construction Capital Costs Download Table

Gst Impact On Construction Capital Costs Download Table

Gst On Real Estate Reduced 1 For Affordable 5 For Under Construction

Know Facts About Gst In Real Estate From Our Experts Here Are Some Facts For You We Have A Special Conference On Gst Join Us Buy My House Finance Sale House

What S The Difference Between Quarterly Taxes Vs Annual Taxes Quarterly Taxes Tax Tax Payment

How Are Basix And Bca Section J Essential For Sustainable Environment Sustainable Environment Environment Sustainability

Hra Rent Receipt Generate Rent Receipt Tax Refund Income Tax Income Tax Return

Source Eenadu Real Estate News Real Estate Marketing Dream Properties

Real Estate Is One Of Those Spheres Of The Indian Economy Where This Gst Regime Has Not Reduced The Crisis Of All The Builders H Real Estate Challenges Economy

Komentar

Posting Komentar